ZKsync's Tokenomics Shift: Utility vs. Revenue

ZKsync's Tokenomics Pivot: A Data Analyst's Reality Check

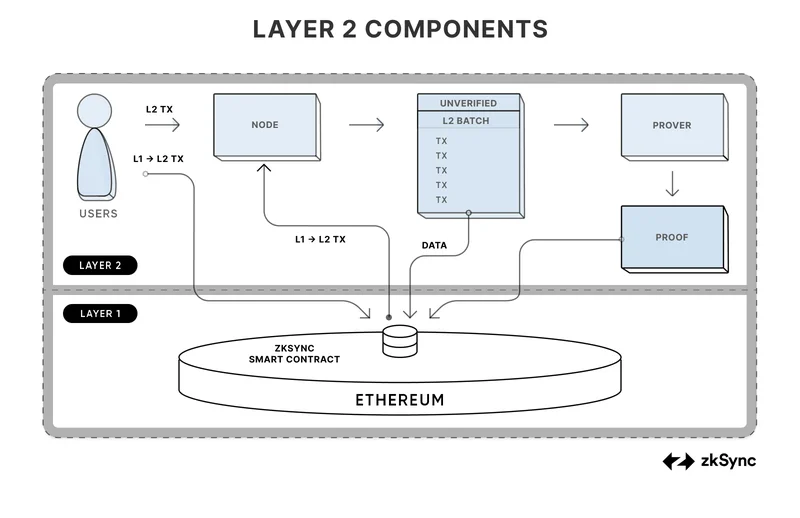

ZKsync is proposing a shift in its ZK token model, moving from a pure governance token to one with "real economic utility." The core idea, as outlined in Alex Gluchowski's proposal, is to tie network usage and enterprise licensing directly to the token's value. Sounds good on paper, right? But let's dig into the numbers and see if this flywheel will actually spin.

The proposal hinges on two main revenue streams: on-chain interoperability fees and off-chain licensing revenue from enterprise tools. The first, interoperability fees, will be charged when users move assets between ZKsync's rollups. The second, licensing revenue, will come from enterprise tools like compliance or reporting modules. The question is, how substantial are these revenue streams likely to be? Details are, shall we say, optimistic at this stage.

The market's initial reaction was predictably enthusiastic. The ZK token jumped over 14% on the day of the announcement, and a whopping 62% for the week. But let's be real: crypto markets are notoriously prone to knee-jerk reactions based on hype, not substance. A 62% jump doesn’t negate the fact that ZK is still down 83% from its all-time high. (And that all-time high was back in June 2024, ancient history in crypto terms.)

What's more telling is the token's current price: roughly 5 cents, translating to a $380 million market capitalization. That's a hefty valuation for a project that's only now proposing a concrete revenue model. Are current valuations justified, or are we looking at another case of overblown expectations?

The Devil's in the Interoperability Fees

The success of the interoperability fee model depends entirely on the volume of cross-rollup transactions. But what volume are we talking about? And what fees will users be willing to pay? If the fees are too high, users will simply avoid cross-rollup transfers, defeating the purpose. It's a classic chicken-and-egg problem.

Then there's the question of competition. ZKsync isn't the only layer-2 scaling solution out there. Other rollups, sidechains, and even entirely different layer-1 blockchains are vying for the same transaction volume. If ZKsync's interoperability fees are higher than those offered by competitors, users will simply go elsewhere. The proposal fails to address this competitive landscape in any meaningful detail.

I've looked at hundreds of these proposals, and this lack of competitive analysis is a recurring red flag. Are they genuinely confident, or simply turning a blind eye to potential threats?

Enterprise Licensing: A Black Box

The second proposed revenue stream, enterprise licensing, is even more opaque. What exactly are these "compliance or reporting modules" that ZKsync plans to offer? How much will they cost? And, most importantly, who will actually pay for them? The proposal offers no concrete details, just vague promises of institutional adoption. ZKsync Proposes Utility and Revenue Focused Tokenomics Shift.

And this is the part of the report that I find genuinely puzzling. Institutions are notoriously risk-averse and slow to adopt new technologies. Why would they choose to build on a relatively unproven layer-2 network like ZKsync when they could stick with more established (if less cutting-edge) solutions? The proposal seems to assume that institutions are clamoring for ZKsync's enterprise tools, but offers no evidence to support this assumption.

Frankly, I suspect that the revenue potential from enterprise licensing is significantly overstated. It's a nice-sounding story, but the numbers simply don't add up.

Is This Flywheel Grounded?

ZKsync's proposal to revamp its tokenomics model is a step in the right direction. Recognizing the need for a utility-driven token is crucial for long-term sustainability. However, the devil is always in the details. Without concrete data on transaction volumes, fee structures, and enterprise adoption rates, it's impossible to assess the true viability of this proposal. The initial market enthusiasm is understandable, but ultimately, it's just noise. A true assessment requires a cold, hard look at the numbers – numbers that, as of now, are conspicuously absent.

Hopeium Isn't a Strategy

Tags: ZKsync

SMCI Stock Slump: Slowing Sales or Buying Opportunity?

Next PostSnap's Stock Soars: Buybacks vs. Perplexity Partnership?

Related Articles