Reddit's RDDT Stock: The Next NVDA or Just Another Meme Stock Flameout?

So let me get this straight.

Reddit reports a monster quarter. Revenue up 78%, blowing past their own guidance. They swung from a loss to a fat $89 million profit. Ninety percent gross margins. A hundred and ten million daily users. Free cash flow of $111 million. By every metric in the MBA textbook, this thing should be a screaming buy.

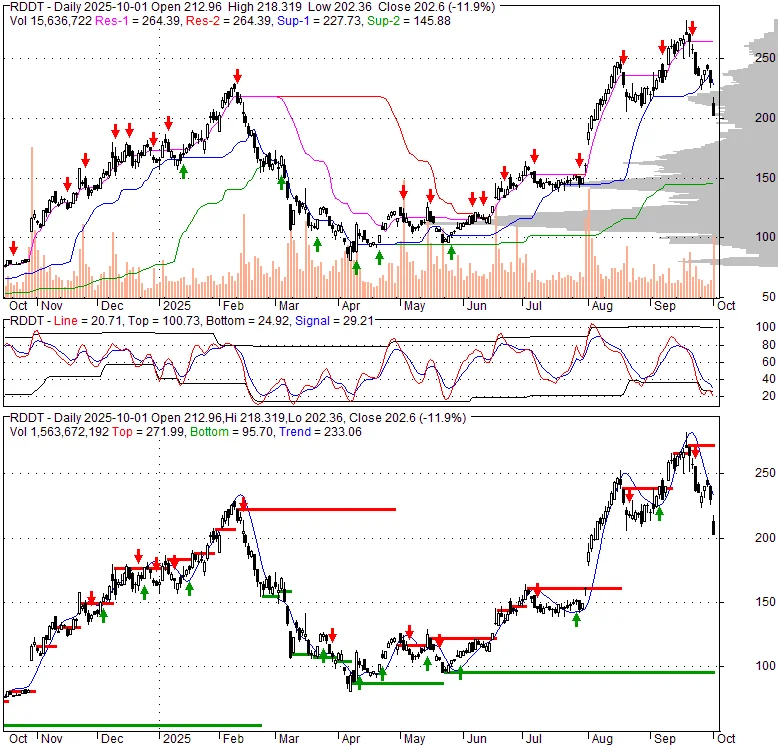

And yet, the `rddt stock price` is getting absolutely throttled.

It closed yesterday around $230, and this morning it was staring down the barrel of $206 in the pre-market. This isn’t some slow bleed; it's a gut punch. A 10% drop in the blink of an eye after nothing but stellar news.

What in the hell is going on here?

The Balance Sheet Is Clean, But the Data Is Dirty

The PowerPoint Reality

If you just read the press releases, you’d think Reddit was the second coming of, I don't know, sliced bread. CEO Steve Huffman gets on the conference call and drops a line like, "Reddit is built for this moment," talking up the value of human conversation in an AI-driven world.

My translation? "We're sitting on a goldmine of text from real, angry, wonderful, and unhinged people, and companies like Google and OpenAI are paying us tens of millions to train their robot brains on it." And he's not wrong. They've got a $60 million deal with the `goog stock` people, another $70 million from OpenAI. They think it could be a $300 million-a-year business soon.

The numbers back it up. They became profitable for the first time ever in Q1 of this year and then blew those numbers out of the water in Q2. They have over $2 billion in cash and basically no debt. Analysts like Keith Noonan are calling it a "profit-generating machine." And with 90% gross margins, yeah, I get it. For every dollar that comes in, ninety cents is pure, unadulterated gravy. That's the kind of margin that makes a company like `nvda` blush.

It’s the perfect story. The kind of thing a banker draws on a whiteboard to get you to sign on the dotted line. A beautiful, clean, upward-sloping chart.

The Insiders Are Cashing Out, But You Should Buy?

The Part They Don't Want You to See

Here's the problem. The stock market isn't a PowerPoint presentation. It's a chaotic, emotionally unstable beast that feeds on hype and fear. And Reddit's stock has been mainlining pure, uncut hype since its IPO back in March 2024.

The stock is up over 600% since its debut. Just this year alone, it’s up 245%. This isn't a company; it's a lottery ticket that hit. And when you're trading at a price-to-earnings ratio of over 200... give me a break. Two. Hundred. That means for every dollar of profit the company makes, investors are paying over $200 for a piece of it. This valuation is insane. No, 'insane' doesn't cover it—it's a full-blown hallucination. We mock `tsla stock` for its wild multiples, but Reddit is in a different galaxy.

And who's selling into this strength? The insiders, offcourse. CEO Huffman himself dumped 18,000 shares in early September. It was only 3.5% of his stake, they'll tell you. But total insider sales in the last 90 days? A cool $82 million. While the company is telling you to buy, the people on the inside are quietly, consistently cashing out. And while the CEO is cashing out millions, you're supposed to...

Then you see the short interest. Somewhere between 16% and 18% of the float is being shorted. That means for every five people betting the stock goes up, there's one very serious player betting a fortune that it's going to crash and burn. That ain't a rounding error. That's a significant chunk of the market looking at this "profit-generating machine" and calling bullshit.

It's gotten so ridiculous now that every company has to have an "AI story." It doesn't matter if you sell widgets or run a social media site. You have to stand on stage and explain how you're leveraging synergistic AI paradigms. It's like this mandatory password you have to say to get into the Wall Street speakeasy. Reddit's password is "data licensing," and it's a good one, but is it worth a 200x P/E ratio? Are we really this desperate for a new hero stock to replace the aging Magnificent Seven?

Then again, maybe I'm the crazy one here. Institutional ownership is almost 90%. Big firms like Union Bancaire Privée are just now opening positions. Wealth Enhancement Advisory upped their stake. The "smart money" is in. But the consensus analyst price target is around $201, which is right where the stock is heading this morning. It seems even the pros who are paid to be optimistic think the party's over.

So you have this perfect storm. A fundamentally strong, fast-growing company attached to a stock priced for intergalactic perfection. A stock that has only known one direction: up. And now, for the first time, it's facing real gravity. The slightest wobble, the slightest hint that growth might not be infinite, and the whole thing could unravel. The drop from the $283 high wasn't a dip; it was a warning shot.

###

Gravity Always Wins

###

Look, I'm not saying Reddit the company is a fraud. It's a real business making real money, and honestly, good for them. But Reddit the stock is something else entirely. It's a belief system. It’s a momentum trade that got way, way out over its skis. The fundamentals they reported are fantastic, but they were already priced in. And then some. And then some more. What we're seeing now isn't a mystery. It's just the bill coming due.

Reference article source:

Tags: rddt stock

PennyMac: Your Login, Payments, and the Customer Service Number You Actually Need

Next PostThe International Space Station: What It Is, Where to See It, and What They're Not Telling You

Related Articles