AMD's OpenAI-Fueled Stock Rally: Let's Be Real About This 'Deal'

So, AMD’s stock shot up nearly 25% in a single day. Let that sink in. A multi-billion dollar company, a cornerstone of the semiconductor industry, just inflated its value by a quarter based on a press release and a handshake with the current prom king of Silicon Valley, OpenAI.

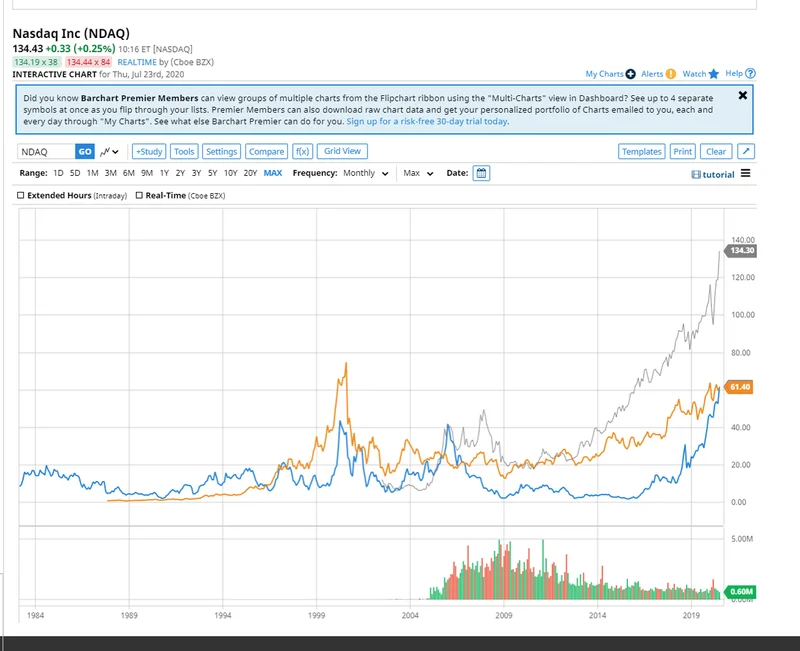

Everyone on Wall Street apparently lost their minds in unison. The Nasdaq hit a record high, the S&P 500 hit a record high, and the financial news channels were practically vibrating with excitement. Stock market today: S&P 500, Nasdaq notch record close as AMD's OpenAI deal sparks wild rally. I watched the ticker climb, and all I could feel was this cold, creeping sense of dread. Am I the only one who sees this for what it is? This isn't investing. This is a high-stakes game of musical chairs, and the music is a distorted, AI-generated remix of the dot-com bubble anthem.

The deal itself sounds incredible if you don’t think about it too hard. OpenAI, the ChatGPT people, signed a "multiyear deal" to buy AMD's chips. Great. And they get the option to purchase up to 10% of the company. An option. We're not talking about a done deal; we're talking about a maybe. A possibility. And for this, the market adds tens of billions of dollars to AMD’s valuation overnight, while the federal government is literally shut down. Give me a break.

The AI Hype Machine Is Officially Overheating

Let's be real. This isn't about fundamentals anymore. This is about narrative. The market has become a storytelling contest, and right now, any story that has the letters "A" and "I" in it wins the grand prize. AMD’s revenue is around $25.7 billion, with a profit margin of about 9%. Respectable numbers, offcourse. But the stock is trading at a price-to-earnings ratio of 95.

Ninety. Five.

That’s not an investment; it’s a prayer. It’s a bet that AMD won’t just grow, but that it will somehow transcend the laws of physics and economics to become a money-printing deity. This is pure, uncut hopium injected directly into the veins of the market. And everyone is chasing the high. Applied Materials, Micron, TSM—they all got a contact high just from being in the same room.

It’s like watching a school of fish. One of them sees a shiny lure—the OpenAI logo—and darts toward it, and suddenly the entire school, thousands of them, turns on a dime and follows, no questions asked. There’s no independent thought, just a collective, primal instinct to chase the shiny object. But what happens when they realize that lure is attached to a very sharp hook? Who gets reeled in then?

This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of speculative mania. We’re valuing companies not on what they earn, but on how closely they can associate their brand with the AI gold rush. They're talking up other partnerships with IBM and Cohere, and even a potential foundry deal with their arch-rival Intel, and the market just nods along, because...

Are We Even Pretending Anymore?

I have a smart speaker on my kitchen counter that still can’t figure out if I want it to play "The Rolling Stones" or call my Aunt Rhonda in Stowe, Vermont. That's the AI we live with day-to-day. Yet we're supposed to believe that this other, god-tier AI is so revolutionary that it justifies completely detaching stock prices from reality?

The whole thing feels fragile. It’s a house of cards built on buzzwords and the fear of missing out. The market is ignoring a government shutdown, ignoring potential interest rate hikes, ignoring everything tangible in the world to chase this digital ghost.

And what happens when OpenAI decides to develop its own chips, like every other tech giant is trying to do? What happens when this "multiyear deal" ends or the revenue isn't quite the "tens of billions" whispered in the press release? What happens when the hype cycle moves on to the next big thing, whether it's quantum computing or blockchain-enabled toasters? Then again, maybe I'm the crazy one here. Maybe a P/E of 95 is the new normal and profits are an outdated concept.

This rally ain't sustainable. It can't be. It’s fueled by the same blind optimism that’s crashed markets time and time again. We're just riding the rollercoaster up, enjoying the view and pretending we don’t hear that clanking sound as the chain lift struggles to pull us over the peak.

It's a Casino, Not a Market

Look, I get it. People want to believe. They want to feel like they’re part of the future, that they’re betting on the next big revolution. But what we saw on Monday wasn't a rational valuation of a company's future prospects. It was a stampede. It was a collective hallucination driven by a single headline. We're not investing in technology anymore; we're gambling on keywords. And in a casino, the house always wins. Always.

Tags: amd stock

The TSM Stock Frenzy: Is It the Next NVDA or Just Hype?

Next PostSX Network's Move to Berachain: Why This Is a Paradigm Shift for Web3 Betting

Related Articles