Rigetti's Quantum Equation: Decoding the Billions in Potential Against Curr...

2025-11-11 2 rgti stock

Rigetti's Quantum Dream vs. The Harsh Reality of the Balance Sheet

The after-hours market is a cold, unforgiving place. There’s no opening bell ceremony, no cheering crowd—just the silent, brutal arithmetic of algorithms and investors reacting to fresh data. For Rigetti Computing (RGTI), that data came in the form of its third-quarter earnings report, and the reaction was a quiet but firm thumbs-down. The stock dipped 2%, a seemingly minor move, but one that speaks volumes about the growing tension between the company's grand vision and its current financial state.

Rigetti is a company built on a promise. It’s not selling widgets; it’s selling access to the future of computation. The problem is that the future doesn’t pay the bills today. The Q3 numbers laid this conflict bare. On one hand, the company posted a smaller-than-expected loss of $0.03 per share, beating the Wall Street consensus of a $0.04 or $0.05 loss. But on the other, more critical hand, revenue came in light. The company generated about $1.9 million—to be more exact, $1.94 million—falling short of the $2.17 million analysts were looking for.

This is the classic "good news, bad news" scenario—reflected in headlines like RGTI Earnings: Rigetti Computing Posts Mixed Financial Results—that often masks a deeper issue. An earnings beat driven by cost management is one thing, but when it’s paired with a revenue miss and a year-over-year sales decline (down from $2.37 million), it paints a picture of a company tightening its belt not out of efficiency, but necessity. You can only cut costs for so long before you run out of things to cut. Growth has to come from the top line, and right now, it isn't.

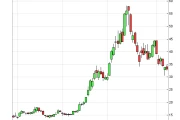

This is where I find the narrative from management genuinely puzzling. In the earnings release, CEO Dr. Subodh Kulkarni spoke of "strong momentum" and collaborations, reiterating an ambitious technology roadmap. The company is on track for a 100+ qubit system by the end of 2025 and is targeting a 1,000+ qubit system by or around the end of 2027. These are monumental engineering goals, the kind of world-changing leaps that get investors excited. They certainly excited the market earlier this year, when the stock more than tripled from September to its October peak (a closing high of $56.34).

But a corporate vision and a balance sheet are two different documents, written in two different languages. The vision is written in the soaring prose of possibility. The balance sheet is written in the cold, hard syntax of arithmetic. And right now, Rigetti’s two documents are telling conflicting stories.

Building a 1,000+ qubit quantum computer is like trying to build the next-generation space shuttle in your garage. The R&D costs are astronomical, requiring sustained, massive capital investment over many years with no guarantee of a commercial payoff. How does a company with less than $2 million in quarterly revenue fund that kind of ambition? Where does the capital come from to bridge the chasm between today's financials and tomorrow's promises? These aren't rhetorical questions; they are the fundamental questions that every investor should be asking. The market seems to be asking them now, which explains why the stock has since deflated back into the low $30s as the speculative air has hissed out.

The analyst consensus reflects this uncertainty. A "Moderate Buy" rating based on five Buys and two Holds is hardly a roaring endorsement. It’s a statistical shrug. It suggests that while some see the long-term potential, others are anchored to the present-day numbers. The average price target of $32 even implies a slight downside from current levels, a clear signal of caution.

Quantum computing has been the beneficiary of significant hype, fueled in part by whispers of government interest. The technology was deemed an R&D priority, and there were even fleeting, contradictory reports about the Trump administration considering equity stakes in firms like Rigetti. This kind of chatter can send a stock soaring, as it detaches the price from fundamentals and ties it to a much grander, geopolitical narrative.

But that catalyst is ephemeral. Once the headlines fade, all you're left with are the numbers. And Rigetti's numbers show a company with a fascinating, potentially revolutionary product that is struggling to find a sustainable business model in the here and now. The stock's 117% rise this year is a testament to the power of that future story. Its recent decline is a testament to the gravitational pull of financial reality.

The core challenge for Rigetti isn't just about hitting its technical milestones. It’s about surviving long enough to see them become commercially viable. The company is asking investors to fund a multi-year R&D project with the promise of a massive payoff at the end. It's a venture capital-style bet placed in the unforgiving arena of the public markets, where quarterly performance is scrutinized under a microscope. Beating a loss-per-share estimate is nice, but it feels like celebrating that you've found a more efficient way to bail water out of a leaky boat. The real solution isn't a better bucket; it's fixing the leak by generating real, sustainable revenue growth.

Let's be clear. Rigetti is not a fraud, and its technology is not vaporware. The science is real, and the goals are audacious. But as an investment, the proposition is based almost entirely on faith in a future that is still years away. The Q3 report was a stark reminder that faith doesn't print on a balance sheet. The market’s muted, negative reaction wasn't an indictment of quantum computing; it was a rational response to a company whose financial trajectory is not yet aligned with its technological ambition. Until that gap closes, Rigetti will remain a high-risk, high-reward speculation, driven more by headlines and hope than by the steady, predictable hum of a growing business.

Tags: rgti stock

Related Articles

Rigetti's Quantum Equation: Decoding the Billions in Potential Against Curr...

2025-11-11 2 rgti stock

Generated Title: Rigetti’s Rocket Ride: Is This the Moment Quantum Computin...

2025-10-04 11 rgti stock